I wrote this article 5 days into 2026 - taking time to reflect on where the last 5 years have taken us, and what might dictate the market as we move forward. One thing to be sure of, however, is that as we move into 2026, the frantic energy of the pandemic-era housing market has officially faded. We are entering a new phase of the Canadian housing market—one defined by balance, sustainability, and a return to "normal" (The Coast).

While national headlines might sound a bit shaky, Halifax continues to stand out as a beacon of stability in Atlantic Canada. Here is the breakdown of what 2026 has in store for our city.

📊 The Numbers: Growth is Steadier, Not Slower

Halifax remains more resilient than major hubs like Toronto or Vancouver. While the national average home price is expected to stay relatively flat at $823,000 (Royal LePage), Halifax is still on an upward—albeit more realistic—trajectory.

Projected Growth: We are looking at a 3% price increase for Halifax throughout 2026 (RE/MAX Canada).

The Average Price Tag: The average residential sale price in the city is now hovering just above $600,000 (RE/MAX Canada).

Detached vs. Condo: Detached homes continue to show the most resilience, while the condo market is seeing a slight softening in price, mirroring a 2.5% decline seen in the national condo sector (Royal LePage / WOWA).

National vs. Local Comparison

🏠 Rents and the "Affordability Gap"

The rental market in Halifax remains a double-edged sword. While record construction has helped increase the vacancy rate slightly, the cost of living remains high.

A one-bedroom apartment in Halifax is averaging roughly $1,770 per month (CityNews Halifax). For many, this "rent trap" is actually driving the transition to homeownership. As rents climb and mortgage rates stabilize, the gap between a monthly rent check and a mortgage payment is narrower than it has been in years (Canadian Mortgage Trends / The Coast).

⚠️ Key Risks & Opportunities to Watch

Even in a stable market, there are variables every buyer and seller should keep on their radar this year:

The Renewal Wave: Many homeowners who locked in low rates in 2021 are facing renewals this year. This "rate shock" could lead to an increase in listings as some owners choose to downsize (RBC Economics).

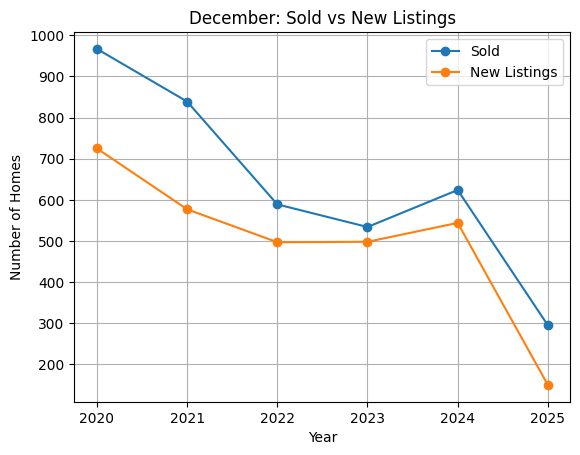

Increased Inventory: Unlike the "bidding war" years, listings have increased modestly, giving buyers more selection and breathing room (RE/MAX Canada).

Negotiation Power: "Subject to inspection" and "subject to financing" clauses have become standard again in Halifax (WOWA), albeit they were absent for only a little while during the pandemic.

💡 Advice for 2026

For Sellers:

The "list it and it will sell" era is over. With a more balanced market, presentation matters. Well-staged homes that are priced accurately based on current 3% growth trends are the ones commanding the best offers (RE/MAX Canada).

For Buyers:

Don’t be afraid to be picky. With more options hitting the market (RE/MAX Canada), you have the luxury of time (within reason). Get your pre-approval in place and look for value in the condo sector, where competition is currently lower (Royal LePage). Another strategy you might try is searching for homes that have been on the market for 90+ days already, as they may be motivated to do a deal or negotiate a price that works for you.

The Bottom Line

2026 isn't about dramatic swings; it’s about a healthy, stabilizing market (Royal LePage). For Halifax, that means your home remains a solid investment, but the "frenzy" is replaced by a much more manageable pace for everyone involved.

Ready to Navigate the 2026 "Great Reset"?

Whether you're looking to capitalize on the stabilizing condo market or wondering how much equity you’ve built in your home during the boom years, you don't have to guess.

🏠 – Get a real-time valuation based on 2026 local Halifax data.

🔍 – See the latest detached homes and condos hitting the market this week.

☕ – Have questions about interest rates or renewals? Let’s build your strategy for the year ahead.

Looking forward to helping you in 2026!